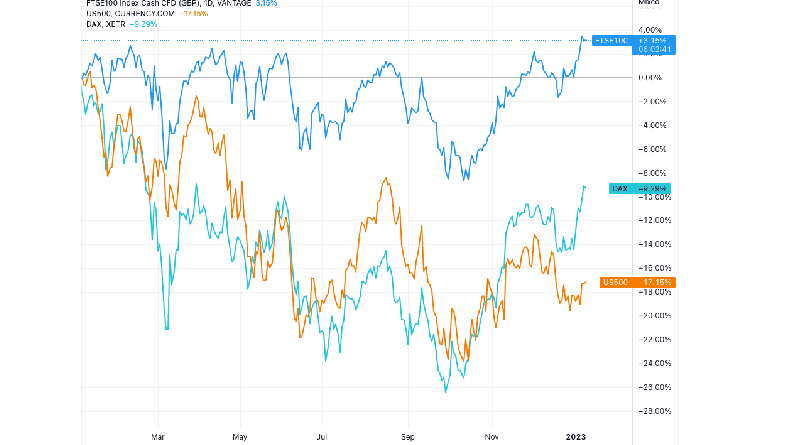

As investors bet that a weak pound will help UK firms overseas and that the worst of the cost of living crisis has passed, the FTSE 100 stock index has closed at a record high. More than a point was added to the day’s final tally for the index of the UK’s largest publicly listed companies, bringing it to 7,901.8. The previous record high was set in May of 2018, so this was the highest level seen in nearly five years. This achievement comes after years of the UK falling behind other major financial markets. The decline in the value of the pound has been good for the stock market, though.

That’s because many companies with significant overseas operations are included in the index of the London Stock Exchange. Their exports to other countries become more competitively priced for foreign buyers thanks to a weak pound, and their investments abroad generate more revenue.

There has been no recovery to the levels seen in 2021 on the FTSE 250, which features more domestically focused firms. In the middle of an economic downturn, such a dramatic increase in the value of our top shares may seem counterintuitive. What really matters, though, is the nature of the work these businesses do and the sources of their revenue.

Companies in the banking and energy sectors dominate the FTSE 100, both of which have done well recently thanks to rising oil and gas prices. In addition, most of the index companies’ revenue comes from abroad, where it is bolstered by a weaker pound relative to the dollar. When compared with the value of companies on other stock markets, the value of those in this index may seem quite low.

Additionally, there are encouraging indicators that inflation rates may be levelling off or even declining, which would make borrowing cheaper and increase the economy’s overall liquidity. Pension fund holders and other investors may welcome the markets’ recent uptick in activity. Only five weeks have passed in what promises to be a very eventful year. Despite the recent decline of the dollar, the value of one pound is currently around $1.21, down 11% from a year ago. As a percentage of the Euro, the pound has lost 6% of its value since this time last year.

A new peak?

According to market analysts, investor confidence was bolstered by signs that the economic outlook is improving, specifically, signs that inflation, the rate at which prices rise, is slowing across key global economies. Market analyst Russ Mould from AJ Bell said, “A lot of the [economic] news seems bad, but markets are saying that was priced in during 2022’s heavy mid-year falls, and the bad news is known.” On Thursday, Andrew Bailey, a senior economist at the Bank of England, predicted that the recession in the United Kingdom would be shorter and milder than had been anticipated.

See Also: Overregulated and underappreciated, India’s private schools are a problem

He also made a cryptic remark about the potential peak of UK interest rates. The Bank’s Monetary Policy Committee (MPC) has stated that it will only implement additional rate hikes if inflation pressures continue to weigh heavily on the economy. According to Michael Hewson, chief market analyst at CMC Markets, the FTSE closing high was a watershed moment for UK investors after years of underperformance. In his opinion, new market highs are possible in the coming weeks. If interest rates stay where they are now, he said, “there’s every reason to suppose that the FTSE 100 can push on further.”

Leave a Reply